Report Overview

The global oil free air compressor market size was valued at USD 11,882.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Increasing demand for oil-free air compressors where air quality becomes crucial is anticipated to drive the market. These compressors provide increased operational effectiveness and extremely dependable operation. Furthermore, compliance adherence to meet global industry benchmarks and limit the degree of oil concentration in compressed air continues to propel application.

To limit the spread of the COVID-19 illness, governments around the world imposed stringent nationwide lockdowns in 2020. As a result, the progress of various sectors and industries has been impeded. Furthermore, the second wave of COVID-19 cases in numerous countries resulted in partial lockdowns around the world. This hampered investments in the oil & gas industry, as well as the market growth.

According to the International Organization of Motor Vehicle Manufacturers, in 2020, 14.5 million light vehicles were sold in the U.S. The U.S. is second in the world for both car manufacturing and sales. In 2020, the U.S. exported 1.4 million new light automobiles, 1,08,754 medium and heavy trucks, and 66.7 billion dollar worth of automotive parts to more than 200 markets worldwide. These exports totaled over USD 52 billion. Additionally, oil-free compressed air offers better painting for automotive, which will promote market expansion in the automotive sector in this region.

According to the Centre for Sustainable Systems, University of Michigan, U.S., around 83% of the U.S. population lives in urban cities, which is expected to reach 89% by 2050. Evolving trends in the food & beverage industry such as partnerships with distribution channels, mass-market brand building, product innovation, digital ubiquity, organic growth strategies, and mergers & acquisitions are widely observed in the U.S. food & beverage industry. The valves and actuators on automated filling, packing, and bottling lines are controlled by compressed air. Airborne oil can accumulate and jam these parts, resulting in price line stoppages, which further propels the market growth.

Leading players are developing low-maintenance and eco-friendly systems to persuade consumers to choose next-generation technologies. To distinguish their products in an extremely competitive environment, companies like Ingersoll Rand Plc; Bauer Group; Cook Compression; and Atlas Copco Inc. have developed advanced technologies with high-performance capabilities.

These technologically advanced oil-free air compressors' major advantages include improved efficiency and decreased noise levels. For instance, OFAC 7-110 VSD+ is a cutting-edge oil-injected compressor that increased the standard for energy efficiency by cutting its energy use by about 50%. As a result, during the projection period, the manufacturers will have an opportunity owing to the adoption of energy-efficient technologies.

Furthermore, the aging population in the U.S. is boosting the pharmaceutical industry's expansion. In addition to the aging and growing population, the U.S. pharmaceutical sector is expanding due to increased purchasing power and access to high-quality healthcare and medications for families in the global lower and middle classes. Moreover, oil-free compressors provide less wastage, greater product purity, efficient processes, and increased safety in the pharmaceutical industry, which will further augment the market growth.

Product Insights

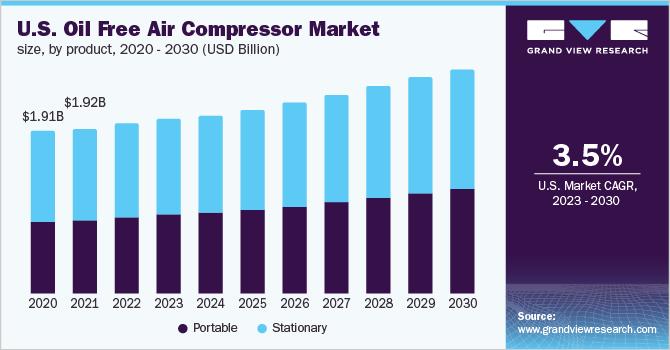

The portable product segment led the market and accounted for 35.7% of the global revenue share in 2022. Growing demand for energy-efficient, low-maintenance devices is expected to be driven by growing industrialization. For instance, the International Energy Agency (IEA) reports that USD 66 billion in funding was provided through government stimulus packages for initiatives related to energy efficiency. These aforementioned factors will drive the demand for portable oil-free air compressors in the coming years.

Portable compressors are widely used in construction & mining activities. Oil-free portable air compressors and generators are dependable power sources utilized mainly for tools and machinery in the construction sector. They are also extensively used across various industrial applications, owing to their convenience in shipping the equipment. These aforementioned factors will drive the demand for portable compressors in construction & mining activities.

The stationary oil air compressors are fixed in one place unlike portables and are preferred for long-term projects. In addition, the stationary air compressor is in high demand for automotive, machinery, and other industrial heavy-duty applications. However, stationary compressors are expected to witness slow growth compared to portable owing to special installation considerations required to mount them.

The stationary product segment is expected to grow at a CAGR of 11.0% over the forecast period. Due to the importance of high-quality products, these products provide a greater tank size, resulting in a higher air-compression capacity, and are widely utilized in the oil & gas and construction industries. These aforementioned factors will drive demand for stationery products in the coming years.

Post time: Oct-20-2023